Unlock the Power of Small Accounting Packages for Your Business

In today's fast-paced business environment, having the right financial tools is crucial. Among these tools, small accounting packages offer an array of benefits that can transform how small and medium enterprises manage their finances. These packages are designed to simplify accounting tasks, providing user-friendly interfaces and essential features tailored to meet the unique demands of businesses. In this article, we will delve into the myriad advantages of small accounting packages, reasons to choose them, and how they can significantly enhance your financial management process.

The Importance of Accounting in Business

Accounting is often referred to as the language of business. It encompasses the systematic recording, reporting, and analysis of financial transactions. Effective accounting is vital for numerous reasons:

- Informed Decision-Making: Accurate financial information leads to better strategic decisions.

- Regulatory Compliance: Proper accounting ensures that a business adheres to laws and regulations.

- Financial Health Assessment: Regular financial reports help gauge the business’s performance and health.

- Tax Preparation: Organized financial records simplify the tax filing process.

What Are Small Accounting Packages?

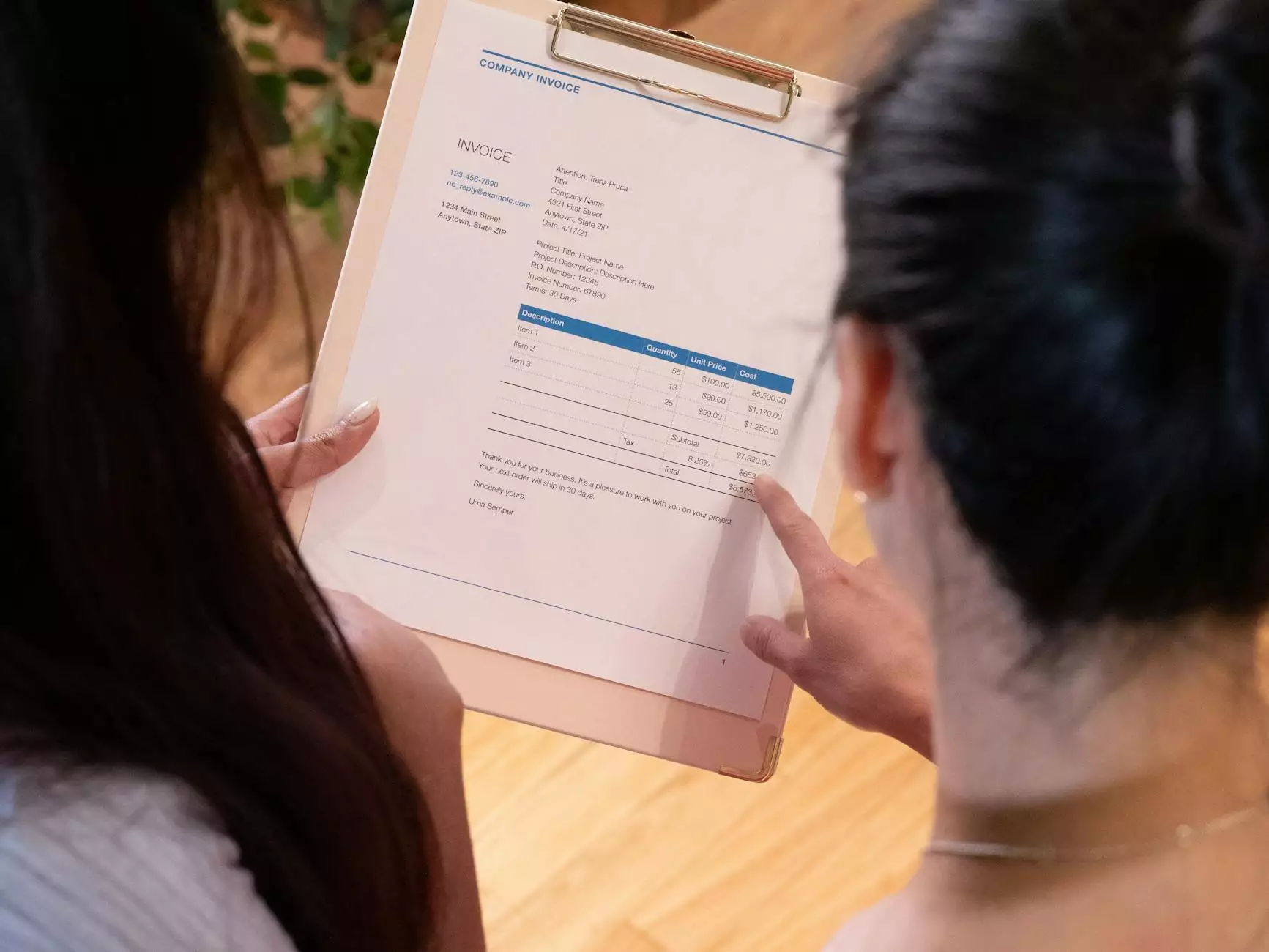

Small accounting packages are software solutions designed specifically for small to medium-sized businesses. They typically include features that cater to the financial management needs of these enterprises, such as:

- Income and Expense Tracking

- Invoicing and Billing

- Financial Reporting

- Tax Management

- Bank Reconciliation

- Inventory Management

Benefits of Small Accounting Packages

1. Cost-Effective Solutions

For small businesses, budget constraints are often a major concern. Small accounting packages provide essential functionalities at a fraction of the cost of full-fledged enterprise accounting software. By investing in these affordable solutions, businesses can allocate their financial resources more efficiently.

2. User-Friendly Interfaces

Many small accounting packages are designed with non-accountants in mind. Their intuitive interfaces enable users to navigate easily, ensuring that even those with little accounting experience can maintain accurate records. This accessibility reduces the learning curve and allows business owners to focus on their core operations instead of grappling with complex software.

3. Automation of Routine Tasks

Automation is one of the most significant advancements in accounting technology. Small accounting packages often come with automated features that handle repetitive tasks such as invoicing, expense tracking, and report generation. This reduces the likelihood of human error and saves time, allowing businesses to concentrate on growth.

4. Real-Time Financial Insights

With small accounting packages, businesses gain access to real-time data regarding their financial status. This immediate visibility into cash flow, outstanding invoices, and expenses enables managers to make quick and informed decisions, ultimately driving better business outcomes.

5. Enhanced Compliance and Reporting

Compliance with financial regulations is a top concern for any business. Utilizing small accounting packages ensures that financial records are accurate and up-to-date, making it easier to meet regulatory requirements. Moreover, these packages simplify the reporting process, allowing businesses to generate statutory reports with ease.

Choosing the Right Small Accounting Package

With a myriad of options available, selecting the right small accounting package can be daunting. Here are several factors to consider:

1. Features and Functionality

Identify your business requirements. Does your business need simple bookkeeping, or do you require more advanced features like inventory management or multi-currency support? Evaluate different packages based on their functionalities.

2. Scalability

Your accounting solution should grow with your business. Opt for packages that offer scalability features to accommodate increasing transaction volumes or additional users as your business expands.

3. Customer Support

Reliable customer support is crucial. Ensure that the provider offers adequate support channels and prompt assistance in case of technical issues or questions about functionality.

4. Reviews and Reputation

Research reviews and testimonials from other users. Understanding how other businesses have benefited from specific small accounting packages can guide your decision-making process.

5. Integration Capabilities

Your accounting software should seamlessly integrate with other business tools such as CRM systems, payment gateways, and e-commerce platforms. This interoperability will streamline your operations and improve overall efficiency.

Implementing a Small Accounting Package

Once you have chosen your small accounting package, proper implementation is key to maximizing its benefits:

1. Data Migration

Carefully transfer existing financial data into the new system. This may require exporting data from previous software and ensuring its accuracy during the import process.

2. Training Staff

Provide comprehensive training to staff members who will use the accounting package. Familiarity with the software is essential for proper management and execution of accounting tasks.

3. Setting Up Processes

Establish clear accounting processes and guidelines for staff. Define how financial transactions are to be recorded, how reports are generated, and outline the audit procedures.

4. Regular Review and Updates

Continuously monitor the effectiveness of your accounting practices. Regular reviews will help you identify any areas for improvement and ensure that your accounting processes remain compliant and efficient.

Conclusion: The Future of Accounting with Small Accounting Packages

In conclusion, the adoption of small accounting packages offers small and medium-sized businesses a myriad of advantages. From cost savings to enhanced compliance and real-time insights, these tools are integral in fostering efficiency and accuracy in financial management. As technology evolves, so does the era of accounting—embracing innovative solutions is essential for businesses looking to thrive in a competitive marketplace.

Make the smart move today by choosing a small accounting package that aligns with your business needs. At BooksLA.com, we provide expert guidance and a range of financial services that can help your business unlock its full potential in financial management.